Welcome to the first installment of Get Real with Doug Robinson. Every other Wednesday Doug will talk about real estate facts and trends and give some advice. This first column compares renting a home to buying.

Owning and renting a home each have their advantages, but what’s best for you depends on your circumstances. Here are some things to keep in mind as you weigh the benefits of renting against the benefits of owning.

In a real estate market where home prices are rising, many have begun to put off the idea of buying a home, choosing instead, to rent for a while. But there is a dilemma: should you keep paying rent, knowing that rent is rising too, or should you lock in your housing cost and buy a home? The fact remains that most Americans believe that Real Estate is the Best long term investment.

Let’s look at both scenarios:

Renting

It is more convenient for your lifestyle. Those whose job requires frequent moves need the flexibility that a 6-12 month lease agreement gives them so they can move to their next assignment.

Many renters believe that renting is cheaper because they do not have to pay for maintenance and repairs. The fact is that landlords work those expenses into your rent.

Renting also brings some financial disadvantages. Homeowners can take advantage of tax deductions that let them claim their property taxes and mortgage interest. Additionally, there is a big risk that your rent will go up every time you renew your lease, as we know the median asking rent has been increased steadily since 1988.

Now let’s look at Homeownership

Let’s just focus on the one big difference between renting and owning, the ability to lock in your housing cost! Assuming you will have a fixed-rate mortgage, your costs are predictable! You will know exactly what your mortgage payment will be for the next 15-30 years. The homeownership rate in 2018 was 64.4%, and has been on the rise. Those households locked in their housing cost rather than wait for their landlord to raise their rent again.

Next, there is the privacy and security, having a space that is solely your own. Plus you have control over your living space, using or decorating as you see fit. Homeowners also have more engagement in their communities; the stakes are raised once your home value is directly tied to the neighborhood.

What are the disadvantages of owning a home? Well, it is a long-term financial commitment! It is not easy to pack quickly and move. You will need time and good planning to do it in a short amount of time.

Bottom Line

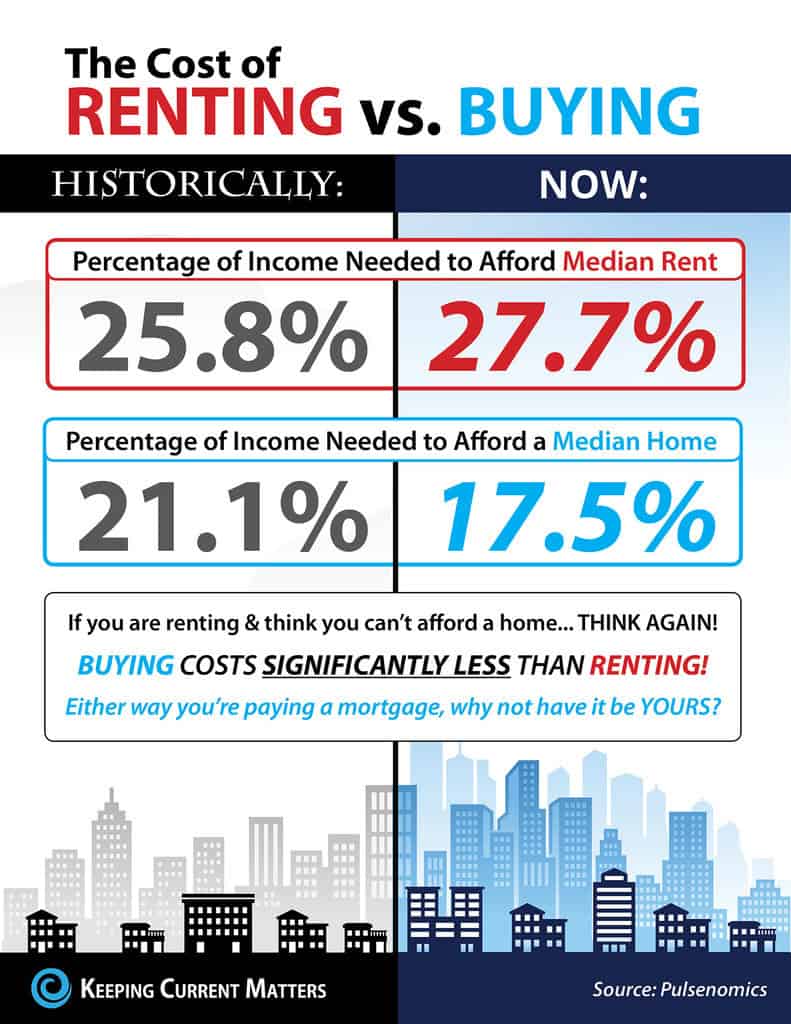

Looking at the percentage of income needed to rent a median-priced home today (27.7%) vs. the percentage needed to buy a median-priced home (17.5%), the choice becomes obvious.

I am speaking about Central Arkansas. Many markets are different but before you renew your lease again, find out if you can put your housing costs to work by buying this year.

If you are interested in becoming a homeowner, contact me. I can help you review your current situation.

Click to see more articles from Get Real with Doug Robinson