With a total of 304 votes FOR the millage and 245 votes AGAINST it, those in the Harmony Grove School District have approved this millage increase by 55.37%. The voting numbers follow:

Harmony Grove School Special Unofficial Results Saline County, Arkansas January 14, 2020 Run Date:01/14/20 07:58 PM TOTAL VOTES % Ele Day Early Absentee PRECINCTS COUNTED (OF 3) . 3 100.00 REGISTERED VOTERS - TOTAL . 0 BALLOTS CAST - TOTAL. . . 551 349 197 5 BALLOTS CAST - BLANK. . . 2 .36 2 0 0 44.6 Mill School Tax (VOTE FOR) 1 FOR Tax . . . . . . . 304 55.37 184 119 1 AGAINST Tax. . . . . . 245 44.63 163 78 4 Over Votes . . . . . 0 0 0 0 Under Votes . . . . . 2 2 0 0

The Harmony Grove School District is holding a special election to ask residents to vote on whether there should be a change in the millage in order to pay for a building addition and other improvements. The election is Tuesday, January 14th, and early voting begins Tuesday, January 7th.

Scroll Down for

Voting Times & Places

and Sample Ballot

The District has plans for nine classrooms, including two science labs, band and vocal classrooms, resource, speech, OT/PT rooms, a media center and a computer lab. There will also be High School administration offices, including a health clinic, guidance counseling, Principal’s office, Assistant Principal’s office, a conference room and teacher work room.

Other improvements will be to resolve drainage issues to eliminate flooding, new “student boulevards” to streamline pedestrian traffic flow and planning for future growth.

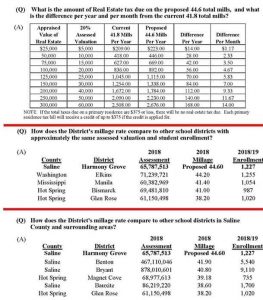

The District is requesting to extend the current debt mills of 16.8 by 9 years, through 2050. They are also asking for an additional 2.8 debt service mills though 2050. The total millage rate would be 44.6 mills. According to the chart the district has provided, if you own a home that is appraised at $100,000, this would be a difference of under $5.00 per month.

The bond issue will produce approximately $1.94 million for refunding the outstanding bonds dates October 1, 2005, May 1, 2016, and May 15, 2016, and will produce approximately $6,500,00 to be used for constructing, refurbishing, remodeling and equipping other school facilities.

The state average for mills is 38.53 as of the 2018 election cycle. See charts below for millage difference per month, rates compared to similar schools, and rates compared to nearby schools.

If you have any questions about this special election, contact the Superintendent of Schools, Heath Bennett at 201-778-6271 or 2621 Highway 229 in Haskell. (Click images below to enlarge.)

EARLY VOTING

- When: Jan 7 – Jan 13, 8:00 a.m. – 4:30 p.m.

- Where: Benton Vote Center, 221 N. Main St., Benton

ELECTION DAY

- When: Jan 14, 7:30 a.m. – 7:30 p.m.

- Where: Haskell Fire Dept., 121 Cardinal Drive, Haskell

BALLOT

Harmony Grove School Special Election – 1/14/2020

44.6 Mill School Tax

The total rate proposed above includes the uniform rate of tax of 25.0 mills (the “Statewide Uniform Rate”) to be collected on all taxable property in the State and remitted to the State Treasurer pursuant to Amendment No. 74 to the Arkansas Constitution to be used solely for maintenance and operation of schools in the State.

As provided in Amendment No. 74, the Statewide Uniform Rate replaces a portion of the existing rate of tax levied by this School District and available for maintenance and operation of schools in this District.

The total proposed school tax levy of 44.6 mills includes 25.0 mills specifically voted for general maintenance and operation, 16.8 mills voted for debt service previously voted as a continuing levy pledged for the retirement of existing bonded indebtedness, and 2.8 new debt service mills.

The 2.8 new debt service mills plus the 16.8 existing debt service mills now pledged for the retirement of existing bonded indebtedness, which debt service mills will continue after retirement of the bonds to which now pledged, will be a continuing debt service tax until the retirement of proposed bonds to be issued in the principal amount of $8,665,000 and which will mature over a period of 30 years and will be issued for the purpose of refunding certain outstanding bonded indebtedness; constructing and equipping High School addition; and constructing, refurbishing, remodeling and equipping other school facilities.

The surplus revenues produced each year by the debt service millage may be used by the District for other school purposes.

The total proposed school tax levy of 44.6 mills represents a 2.8 mill increase over the current tax rate.

FOR Tax

AGAINST Tax