How Covid-19 is affecting the Housing Market in Saline County

In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data. Digging into past experiences by reviewing historical trends and understanding the peaks and valleys of what’s come before us is one of the many ways we can confidently evaluate any situation.

That said, we can be confident that, while we don’t know the exact impact the virus will have on the housing market, we do know that housing isn’t the driver.

With the housing crash of 2006-2008 still visible in the rear-view mirror, many are concerned the current correction in the stock market is a sign that home values are also about to tumble. What’s taking place today, however, is nothing like what happened the last time. The S&P 500 did fall by over fifty percent from October 2007 to March 2009, and home values did depreciate in 2007, 2008, and 2009 – but that was because that economic slowdown was mainly caused by a collapsing real estate market and a meltdown in the mortgage market.

This time, the stock market correction is being caused by an outside event (the coronavirus) with no connection to the housing industry. Many experts are saying the current situation is much more reminiscent of the challenges we had when the dot.com crash was immediately followed by 9/11.

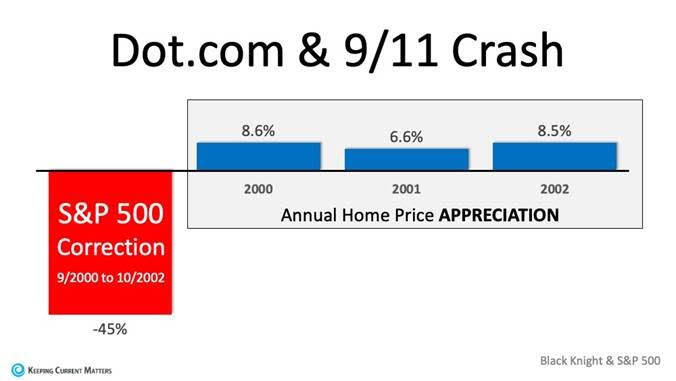

Since the current situation resembles the stock market correction in the early 2000s, let’s review what happened to home values during that time.

The S&P dropped 45% between September 2000 and October 2002. Home prices, on the other hand, appreciated nicely at the same time. That stock market correction proved not to have any negative impact on home values.

Here in Saline County, we currently have not seen any indication of a drop in home values. Sellers are still getting showings and we are listing new homes every day. If you have gotten out during this at all you will see home construction continuing. Framers are framing, plumbers are plumbing and electricians are still pulling wire. If you drive Highway 5 you will see that they are moving along with the road construction at the same rate.

Another concern is interest rates. There was some volatility last week because of the stock market, but the market is climbing again and the rate sheets that I received today show most loan programs still under 3%. That’s about as good as it has ever been! These low rates have created more excitement in Homebuyers than the stock market correction.

The reasons we move – marriage, children, job changes, retirement, etc. – are steadfast parts of life. As noted in a recent piece in the New York Times, “Everyone needs someplace to live.” That won’t change. As we come out of this unprecedented period in time, I believe that our economy will come roaring back. We may do things as a society a little different but it will not change our desire to own a place of our own.

Another note: I had a client that called me today and they told me their house got TP’d last night. They were positive that it made their home triple in value! J

Seriously, if you are ready to make a move by either buying or selling, please give me a call and we can begin the process while still practicing social distancing.

Click to see more articles from Get Real with Doug Robinson

-Doug Robinson/Baxley-Penfield-Moudy Realtors

“Your Best Friend in Real Estate”

www.SalineCounty.RealEstate

Connect with me on my Homesnap account! The best way to search for a home! https://www.homesnap.com/Doug-Robinson