You wake up in a cold sweat. There’s something lurking in the dark, visible by flickering computer light. Something’s haunting you. It’s… the real estate listings! Deep down, you’d love to own a home, but whenever you take steps beyond idle window-shopping, a chill runs up your spine, and paralyzes you from moving ahead. We get it—you’re about to make a life-changing purchase, and you’re spooked. The main thing that home buying has in common with horror flicks: The fears are (mostly) mere figments of your imagination.

So in case you’re harboring some heebie-jeebies, here are some of home buyers’ top concerns—tackled head on so you know what you’re really dealing with.

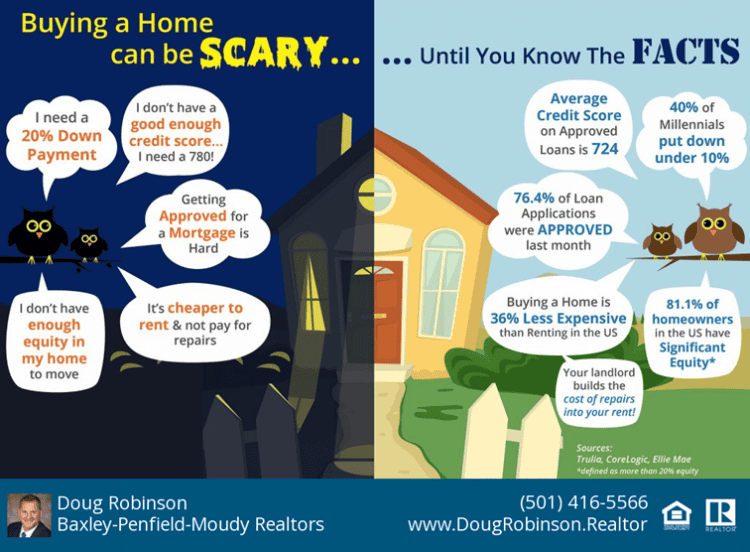

Fear #1: Your credit score is too low to qualify for a loan.

Lenders evaluate several factors when determining whether to approve you for a loan. While your credit score is just one of those factors, it’s an important one.

Before you apply for a loan, review your credit report so you know where your credit score stands. If you see any errors, don’t hesitate to dispute them with the credit bureau that’s reporting the information. If you have any collection accounts on your record, consider paying them off, which could improve your credit standing.

Fear #2: You have too much debt or not enough income.

Along with your credit score, lenders also consider your debt-to-income ratio. This refers to how much of your income goes toward your debt each month. Each lender has its own set of standards regarding what’s an acceptable debt-to-income ratio; so the less income you have going toward debt, the better.

Fear #3: You won’t have enough cash for the down payment.

If the prospect of putting 20 percent down on a home is adding to your house buying stress, don’t fret. It is possible to purchase a home with less than 20 percent down; there are many programs in Arkansas that allow for no down payment.

Fear #4: Your interest rate will be too high.

Your mortgage’s interest rate determines how much your loan costs over time. Even a small difference in rates can significantly impact what you pay for a home loan.

For example, let’s say you’re buying a $200,000 home with a 20 percent down payment. You opt for a traditional 30-year loan with a fixed rate of four percent. Over the life of the loan, you’d pay $114,991 in interest on top of the home price of $200,000. If, however, you instead qualified for a rate of 4.5 percent, the total interest paid climbs to $131,851 — that’s a total difference of $16,860 over time from just one-half of a percentage point.

Fear #5: You won’t have enough money to cover closing costs.

Down payments aren’t the only time you’ll need cash to buy a home. You also need to add closing costs to the equation. Closing costs typically range from two to five percent of the purchase price. Talk with me or my team for the options you have. Depending on your loan it may be possible for the seller to help with this.

Fear #6: You won’t be able to afford your mortgage long-term.

Buying a home is a major financial commitment, and the prospect of not being able to keep up with your mortgage payments on top of other homeownership costs is certainly worrisome. Setting up an emergency fund to cover maintenance, upkeep, and unexpected repairs is one way to ease those fears. Also take a realistic look at your home buying budget and calculate how much home you can afford, erring on the conservative side to be safe.

The Bottom Line

It’s natural to feel some anxiety over buying a house, but the great feeling that comes from owning a home of your own can easily outweigh any jitters you might have. Still nervous? Give me a call and lets lose the Heebie-Jeebies!

Click to see more articles from Get Real with Doug Robinson

-Doug Robinson/Baxley-Penfield-Moudy Realtors

“Your Best Friend in Real Estate”

www.SalineCounty.RealEstate

Connect with me on my Homesnap account! The best way to search for a home! https://www.homesnap.com/Doug-Robinson