I have dealt with several first-time home buyers lately who have had no idea of where to start in buying their first home. This is exciting to me because I enjoy educating and showing my clients how easy the process is if they are prepared and are willing to communicate with their lender and Real Estate professional. In fact, it is the communication that is vital to the whole process going smoothly.

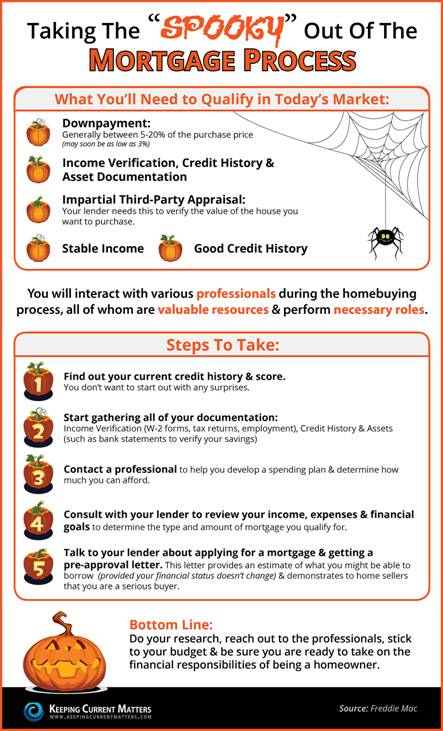

A considerable number of potential buyers shy away from jumping into the real estate market due to their uncertainties about the buying process. A specific cause for concern tends to be mortgage qualification.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and good credit history. There are even some loan programs available here in Saline County that require NO money down!

Throughout the entire home buying process, you will interact with many different professionals who will all perform necessary roles. These professionals are also valuable resources for you. They want you to ask questions.

Once you’re ready to apply, here are 5 easy steps that you need to follow:

- Find out your current credit history & score – even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® of all closed loans in September was 731, according to Ellie Mae.

- Start gathering all of your documentation – income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact Me! – as your real estate agent I will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender – he or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage for which you qualify.

- Talk to your lender about pre-approval – a pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you are serious about buying!

Bottom Line

Do your research, reach out to my team, stick to your budget, and let’s go find you a new home! Once you have all your ducks in a row, the fun begins!

Click to see more articles from Get Real with Doug Robinson

-Doug Robinson/Baxley-Penfield-Moudy Realtors

“Your Best Friend in Real Estate”

www.SalineCounty.RealEstate

Connect with me on my Homesnap account! The best way to search for a home! https://www.homesnap.com/Doug-Robinson