The pumpkin spice latte is launching soon, so you may be tempted to spend your extra cash on a daily caffeine fix, but that small expense can add up to a big number – fast!

Saving for a down payment takes a little discipline, so limiting your extra purchases (like a latte a day from your favorite coffee shop) will help you get there faster.

Depending on where you live, putting away just a small amount each day will get you to the average down payment you may need for homeownership faster than you think.

The big surprise is that according to the Realtors Confidence Index from the National Association of Realtors, 61% of first-time homebuyers purchased their homes with down payments below 6% in 2018. Many potential homebuyers believe that a 20% down payment is necessary to buy a home and have disqualified themselves without even trying, but in the first part of the year more than half of all buyers put less than 20% down.

It’s no surprise that with rents rising, more and more buyers are taking advantage of low-down-payment mortgage options to secure their monthly housing costs and finally attain their dream homes.

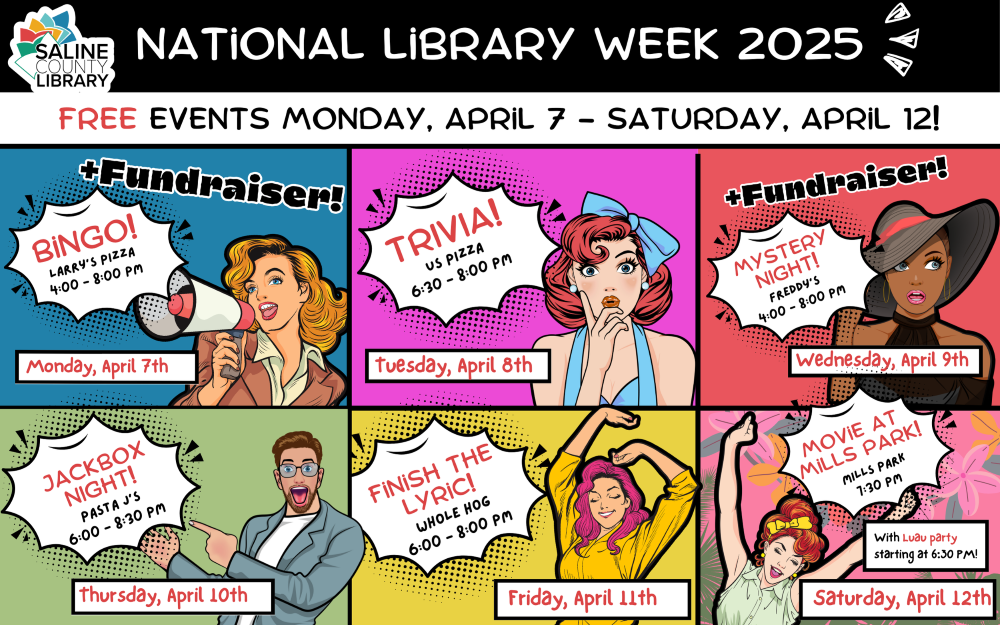

In Arkansas and Saline County in particular we rank in the Top 10 states with the lowest down payments. That means that the percentage of people putting down less money, or none at all is even greater.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

Most Americans who plan to buy or have already bought a home admit to their concerns about their ability to afford a home in the current market. In addition, many are currently unfamiliar with alternative down payment options. What these people don’t realize, however, is that there are many loans written with down payments of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO Scores

Most people believe they need excellent credit to buy a home, with many thinking a “good credit score” is over 780. In actuality, the average FICO scores for approved conventional and FHA mortgages are much lower.

The average conventional loan closed in May had a credit score of 753, while FHA mortgages closed with an average score of 676. The average across all loans closed in May was 724. The chart below shows the distribution of FICO Scores for all loans approved in May.

The Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but you are not sure if you are ‘able’ to, contact me and I can put you with the right team to explore your true options today. We can set you on your path to homeownership!

Click to see more articles from Get Real with Doug Robinson

-Doug Robinson/Baxley-Penfield-Moudy Realtors

“Your Best Friend in Real Estate”

www.SalineCounty.RealEstate

Connect with me on my Homesnap account! The best way to search for a home! https://www.homesnap.com/Doug-Robinson