The City of Benton will hold a third public hearing in an effort to inform the public and encourage involvement with the proposal for a new Advertising and Promotions tax (A&P tax). This would be a City ordinance to establish a 1.5% sales tax on hospitality businesses in the city limits of Benton, Arkansas, to use for improvement projects. The meeting will be held on Monday May 17th, 2021 at 6 p.m. at the Benton Event Center, 17322 I-30 N in Benton.

This article is an attempt to give as much information as possible about what the City is proposing – including a one-hour video interview, an outline of how voting, projects and a bond come together, and illustrations of possible projects.

See sections below titled…

- The Video Interview,

- The Misconceptions,

- State Laws,

- What Do We Have Now,

- What’s Possible,

- Illustrations, and

- Ordinances.

THE VIDEO INTERVIEW:

The video below is Benton Mayor Tom Farmer and City Attorney Baxter Drennon who sat with Shelli Poole of MySaline to answer questions about the basics, the history, the process and the future for the A&P tax:

THE MISCONCEPTIONS:

The video interview answered lots of questions, but the main misconceptions are concerning the process of creating an A&P tax, how it’s collected, deciding on projects and when citizens might vote. If we’re going to have a new A&P tax, this is how it will go:

1. City Council votes for A&P tax. State law authorizes city governments (municipalities) to do this. See the relevant Arkansas State Laws in next section below.

2. Tax then comes in from customers spending money in restaurants (and other prepared food businesses) and hotels. The businesses pass on the tax monthly to the A&P Commission.

3. Meanwhile, the City develops a plan for how to use the tax revenue collected.

A. City can use it on small projects, as funds are collected,

B. City can save the money for later, or

C. City can get a lump sum of funds by borrowing against future tax collections (with a bond).

4. When do citizens vote?

A. If the City decides to use the tax money as it comes in, there is no need for a vote from the public.

B. If the city decides to borrow against future tax collections, they need to get it approved by a vote from the citizens and then go to a financial firm and get a bond issued – similar to the way an individual would go to a mortgage bank to borrow against future earnings to buy a home.

5. What if the ballot measure doesn’t get enough votes?

If the majority of the public votes that they do not want a bond for the proposed projects, the City will still be collecting the tax, per the ordinance referenced in #1 of this outline. So if there aren’t enough votes from citizens, Plan B is likely to do one of these:

A. Use the tax money for smaller projects as it comes in, or

B. Save the tax money as it comes in and use it later projects, or

C. Make another plan and ask citizens to vote again.

D. The City cannot borrow against future tax revenue (get a bond) without the citizens’ approval in a vote.

STATE LAWS:

See the bulleted list below for links to sections in Arkansas State Law where it references how the creation of an A&P Commission and Tax comes about, how it’s collected, what it can be used for, and how an arts and entertainment district may be related to it.

That last one is especially important because there is already one Arts and Entertainment District in the city limits of Benton, at The Palace. It accommodates customers from Baja Grill and Valhalla Restaurant and Axe Throwing, for when they wish to bring an alcoholic beverage outside of the restaurants and into the patio and courtyard area. According to state law, you cannot have an Entertainment District without an A&P tax.

- §26-75-602, Gross Receipts Taxes Authorized

- §26-75-603, Payment

- §26-75-606, Use of Funds Collected

- §14-54-1412, Designated Entertainment Districts

WHAT DO WE HAVE NOW?

There is a current A&P tax being collected in Benton that, among other things, funded the construction of Benton Event Center, as well as some maintenance costs. The current tax will sunset in the Spring of 2022. This ordinance would continue a tax that began in 2011 and helped to build the Benton Event Center, now a successful venue.

WHAT’S POSSIBLE?

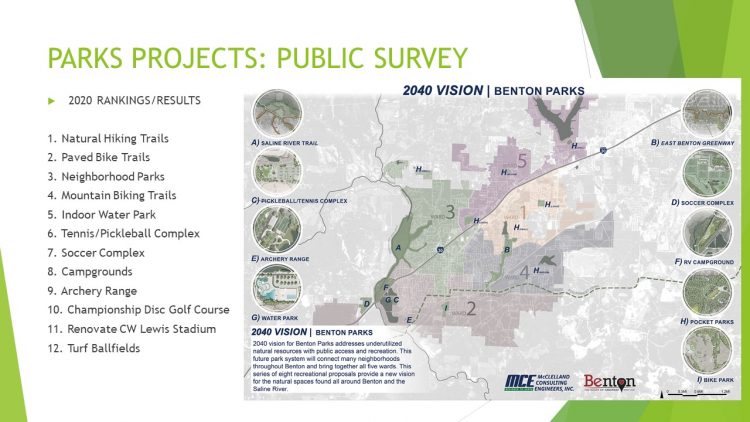

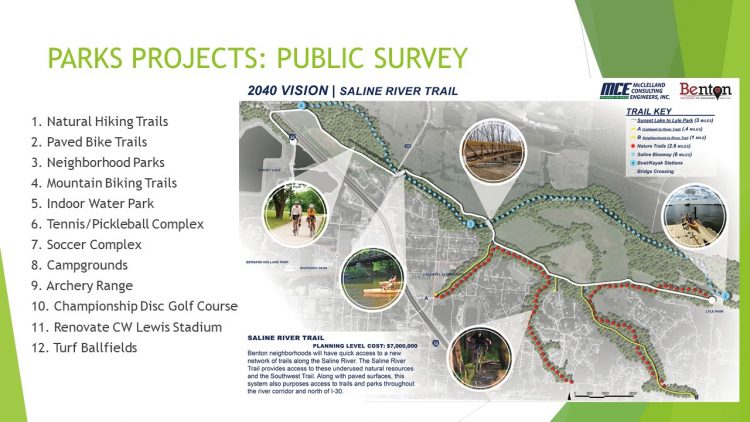

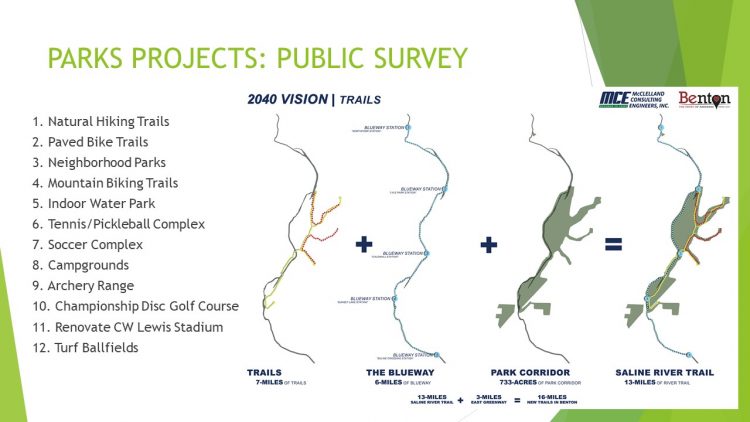

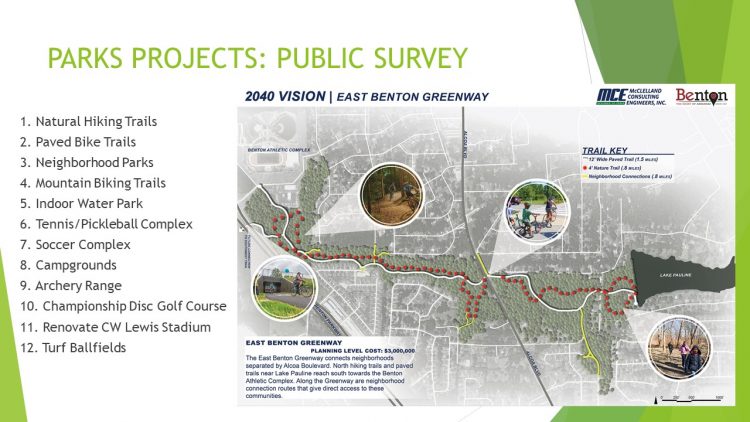

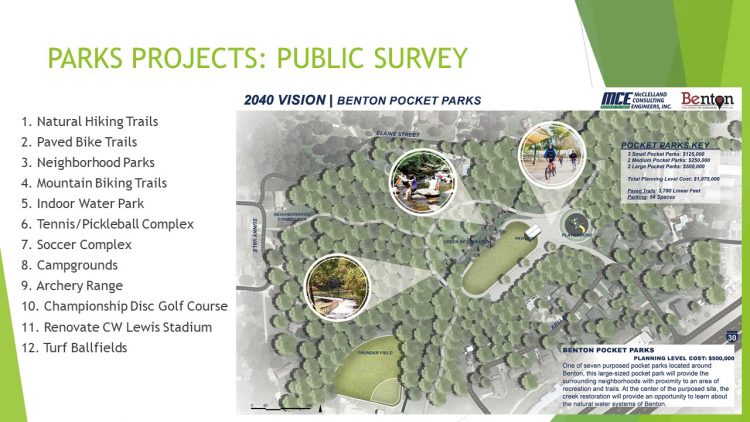

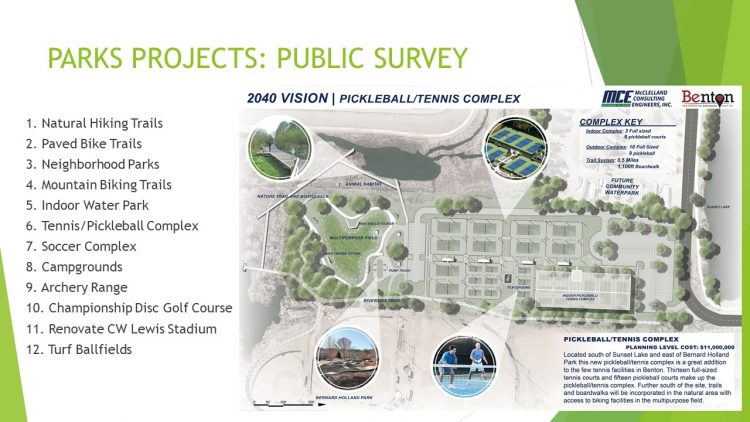

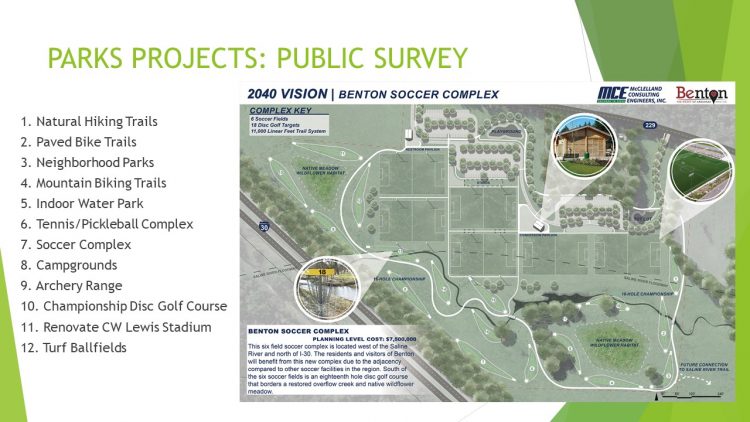

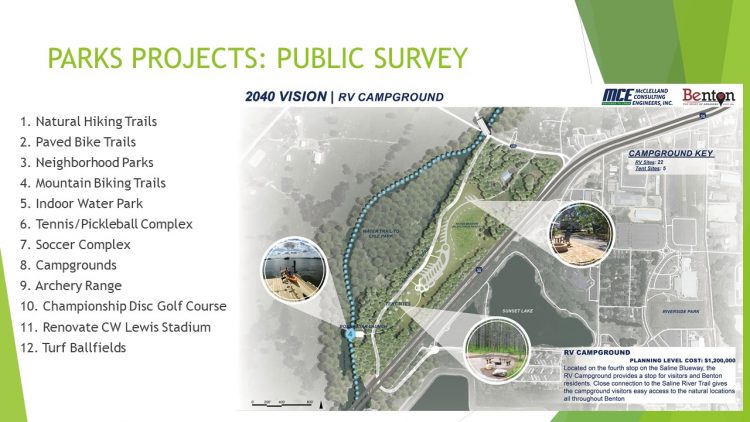

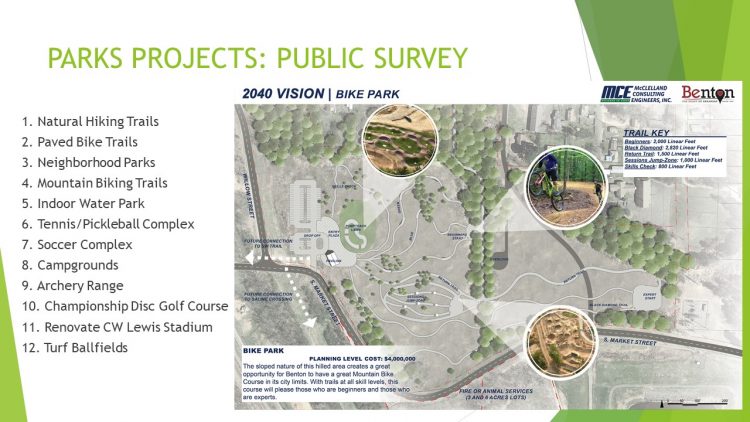

At the first two public hearings, representatives from McClelland Consulting Engineers presented Vision 2040 that the City of Benton is exploring with McClelland Consulting Engineers, Inc. It involves the following list of improvements (illustrations below that):

- Hiking and biking trails,

- Neighborhood parks,

- Pickleball,

- Tennis,

- Soccer,

- Campgrounds,

- Archery,

- Disc golf,

- Ball fields and

- Renovation of CW Lewis Stadium.

If all the improvements were made, the City estimates it will add 17 full-time jobs and 57 part-time jobs.

ILLUSTRATIONS:

See illustrations of possible projects below and if you’re a City of Benton resident, talk to your city council member with your questions. Find contacts to your council members at this link: www.mysaline.com/elected-officials

ORDINANCES:

Here is the description of proposed Ordinance 11 of 2021:

An ordinance amending Ordinance No. 46 of 2005, as amended by Ordinance No. 50 of 2011, establishing a one and one-half percent (1.50%) tax upon the gross receipts or proceeds of hotels, motels, restaurants, cafes, cafeterias, and similar businesses in the city of Benton, Arkansas, for advertising and promoting the City; and for other purposes.

Ordinance No. 50 of 2011 – Amending Ord 46 of 2005 – Establishing the 1.5% A&P Tax

An ordinance amending Ordinance No. 46 of 2005 establishing a one and one-half percent (1.50%) tax upon the gross receipts or proceeds of hotels, motels, restaurants, cafes, cafeterias and similar businesses in the city of Benton, Arkansas for advertising and promoting the city and other purposes; declaring an emergency and prescribing other matters pertaining thereto.

Ordinance No. 46 of 2005 – Establishing an Advertising & Promotion Commission

An ordinance establishing an Advertising and Promotion Commission for the city of Benton; levying a gross receipts tax pursuant to the Arkansas “advertising and promotion commission act;” and, for other purposes